Stripe vs LemonSqueezy vs Polar vs Creem - choosing the right SaaS payment provider

Compare top SaaS payment providers to find the best solution for your business. Analyze Stripe, LemonSqueezy, Polar, and Creem to make an informed choice.

In today's digital economy, selecting the right payment provider is crucial for SaaS businesses. With various options available, each offering different features, pricing models, and compliance solutions, making the best choice for your specific needs can be challenging.

This comprehensive guide compares four leading SaaS payment providers - Stripe, LemonSqueezy, Polar, and Creem - to help you make an informed decision that aligns with your business goals.

Understanding SaaS Payment Providers in Today's Digital Economy

SaaS businesses operate differently from traditional e-commerce companies. They rely on recurring revenue models that require specialized payment solutions capable of handling subscription billing, managing recurring payments, and supporting flexible pricing structures. The right payment gateway doesn't just process transactions—it becomes a critical part of your business infrastructure that can significantly impact your operations, customer experience, and revenue potential.

What are SaaS payment providers and why are they important?

SaaS payment providers are specialized payment processing platforms designed specifically for subscription-based business models. Unlike standard payment processors, these solutions offer features tailored to the unique needs of software companies:

- Automated recurring billing that handles subscription renewals without manual intervention

- Subscription management tools allowing customers to upgrade, downgrade, or change their plans

- Dunning management to recover failed payments and reduce revenue leakage

- Revenue analytics providing insights into metrics like MRR, churn, and customer lifetime value

For SaaS businesses, these specialized features aren't just nice-to-have—they're essential for managing cash flow, reducing churn, and scaling operations efficiently. The right payment provider can automate complex billing processes, ensure compliance with tax regulations, and provide valuable data for business decisions.

Key differences between payment processors and merchants of record

When evaluating SaaS payment providers, one of the most important distinctions to understand is between payment processors and Merchants of Record (MoR):

Payment processors like Stripe handle the transaction processing but leave tax compliance, legal responsibilities, and regulatory requirements to the merchant (your business). This means:

- You remain the seller of record for all transactions

- You're responsible for collecting and remitting taxes in all jurisdictions where you have customers

- You must maintain compliance with varying international regulations

- You typically pay lower transaction fees but shoulder more administrative burden

Merchants of Record (MoR) like LemonSqueezy take on the legal responsibility for selling your product, essentially acting as an intermediary between you and your customers. This means:

- The MoR becomes the official seller of your product or service

- They handle tax calculation, collection, and remittance in all applicable jurisdictions

- They ensure compliance with international regulations and requirements

- They typically charge higher fees to cover these additional services

This distinction is particularly important for SaaS businesses selling globally, as tax compliance across multiple jurisdictions can become extremely complex and resource-intensive. The decision between using a payment processor or a Merchant of Record often comes down to balancing cost against administrative overhead.

What features should you look for in a SaaS payment provider?

Choosing the right SaaS payment provider requires evaluating several key features that can significantly impact your business operations and growth potential. Here are the essential capabilities to consider:

Check out our billing and subscription management guide for more information on the features you should look for in a SaaS payment provider.

Essential payment processing capabilities

At a minimum, any SaaS payment provider should offer these core features:

-

Multiple payment method support - Your payment gateway should accept various payment options including:

- Credit and debit cards (Visa, Mastercard, American Express, etc.)

- ACH transfers and direct debit for recurring payments

- Digital wallets like Apple Pay, Google Pay, and PayPal

- Local payment methods for international markets

-

Robust security and compliance - Look for providers that offer:

- PCI DSS compliance to protect payment data

- Strong customer authentication (SCA) for European customers

- Fraud detection and prevention tools

- Data encryption and tokenization

-

Reliability and uptime - Payment processing downtime directly impacts your revenue, so prioritize providers with:

- Documented uptime guarantees (99.9%+ is standard)

- Transparent status reporting

- Redundant systems to prevent outages

- Clear incident response procedures

According to industry research, payment failures can contribute to up to 40% of SaaS customer churn. Choosing a reliable payment provider with robust recovery tools is essential for maintaining healthy recurring revenue.

Advanced features for scaling SaaS businesses

As your SaaS business grows, these advanced features become increasingly important:

-

Revenue recovery tools - Smart dunning management that automatically retries failed payments using intelligent retry logic can recover up to 20-30% of potentially lost revenue

-

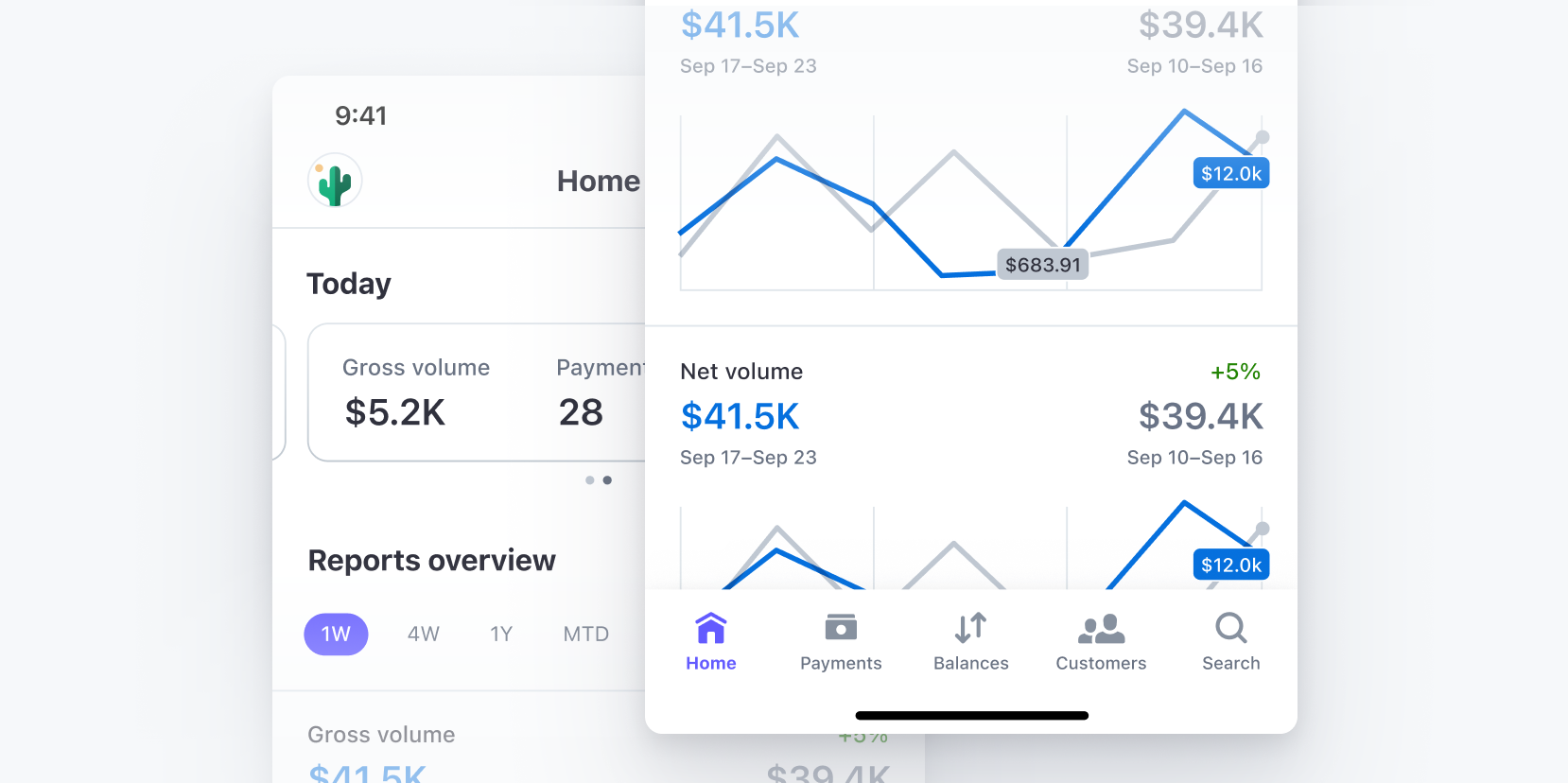

Comprehensive analytics - Detailed reporting on key metrics like MRR, churn rates, conversion rates, and customer lifetime value

-

Flexible pricing models - Support for various subscription structures:

- Tiered pricing plans

- Usage-based billing

- Hybrid models combining fixed and variable components

- Free trials and freemium conversions

- Promotional discounts and coupons

-

Customer self-service portals - Interfaces that allow customers to:

- Update payment methods

- Change subscription plans

- View billing history and download invoices

- Manage account details

The right combination of these features will depend on your specific business model, customer base, and growth stage. A startup with a simple pricing model may prioritize ease of use and quick setup, while an enterprise SaaS with complex pricing tiers might need advanced customization capabilities.

Comparing Payment Gateway Fees and Pricing Structures

Understanding the true cost of different payment providers requires looking beyond the advertised transaction fees. Each provider has a unique pricing structure that can significantly impact your bottom line.

Understanding fee structures and hidden costs

Here's a breakdown of common fee components to consider:

| Fee Type | Description | Typical Range |

|---|---|---|

| Transaction Percentage | Percentage of each transaction amount | 1% - 5% |

| Fixed Transaction Fee | Flat fee charged per transaction | $0.10 - $0.50 |

| Monthly Subscription | Regular fee for using the platform | $0 - $500+ |

| Setup Fee | One-time cost to establish the account | $0 - $1,000+ |

| Chargeback Fee | Fee charged when a customer disputes a charge | $15 - $100 |

| Currency Conversion | Fee for processing transactions in foreign currencies | 1% - 3% |

| Payout Fee | Cost to transfer funds to your bank account | $0 - $25 |

Many providers also have tiered pricing structures where rates decrease as your volume increases. Additionally, some features may only be available on higher-tier plans, effectively increasing your costs as you need more advanced functionality.

How to calculate the true cost for your business model

To accurately compare payment providers for your specific SaaS business, follow these steps:

Estimate your monthly transaction volume and average transaction size

Calculate the basic processing fees using each provider's published rates

Factor in additional costs for features you'll need (that might be premium add-ons)

Consider the value of time saved through automation (especially tax compliance)

Project costs as your business grows to ensure the solution scales economically

For example, a SaaS business processing $50,000 monthly with an average transaction size of $100 would pay approximately:

- Stripe: $1,450 in transaction fees (2.9% + $0.30 per transaction)

- LemonSqueezy: $2,750 in transaction fees (5% + $0.50 per transaction)

However, this simple calculation doesn't account for the value of LemonSqueezy's Merchant of Record services, which might save thousands in accounting and legal fees related to tax compliance. The true cost comparison must include these operational savings.

Stripe: The Enterprise-Grade Payment Processing Solution

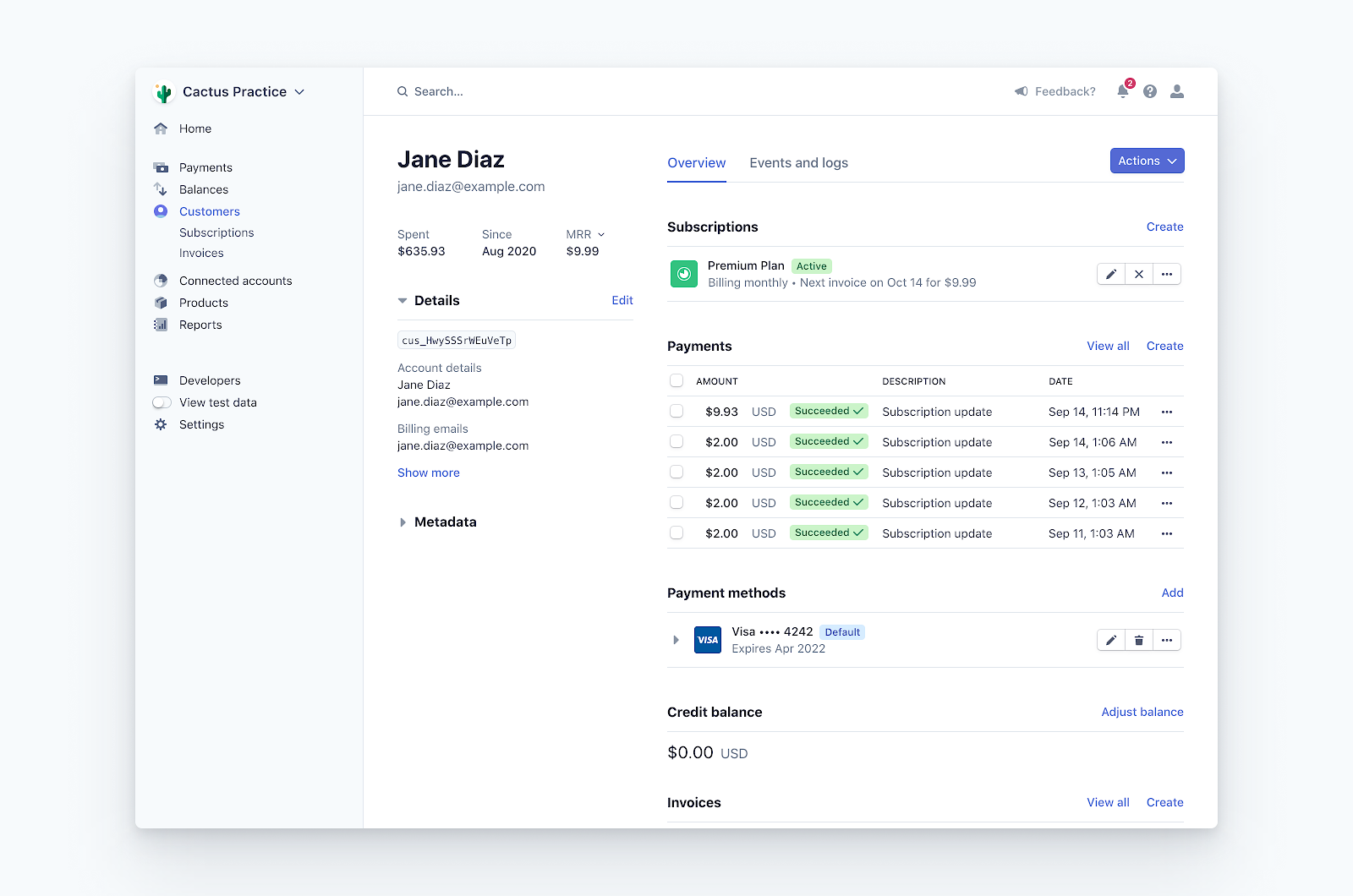

Stripe has established itself as the industry standard for payment processing, offering unparalleled flexibility, extensive documentation, and global reach. It's the preferred choice for businesses that need maximum control over their payment infrastructure and have the technical resources to implement a customized solution.

Stripe's core features and capabilities

Stripe offers a comprehensive suite of payment tools designed to handle virtually any payment scenario:

-

Highly customizable checkout experiences through:

- Stripe Checkout for quick implementation

- Stripe Elements for custom UI components

- Stripe.js for complete frontend control

- Hosted payment pages or embedded forms

-

Extensive API documentation and developer tools including:

- Well-documented RESTful APIs

- SDKs for major programming languages

- Webhook support for event-driven architectures

- Comprehensive testing tools and sandbox environments

-

Global payment support covering:

- 135+ currencies

- Local payment methods in key markets

- Intelligent routing to optimize acceptance rates

- Compliance with regional regulations

Stripe also offers Stripe Billing, a dedicated subscription management system that handles recurring billing, invoicing, and subscription lifecycle management. This makes it particularly well-suited for SaaS businesses with complex billing requirements.

Pros and cons of using Stripe for SaaS

- Lower transaction fees (2.9% + $0.30 for standard processing) - Unmatched customization options for creating tailored payment experiences - Extensive API and documentation making integration possible with virtually any system - Global payment method support to serve customers worldwide - Robust subscription management through Stripe Billing - Advanced fraud prevention tools to reduce chargebacks - Scalable infrastructure that grows with your business

- Requires significant development resources to implement and maintain - Doesn't handle tax compliance as a Merchant of Record - May require additional tools for complete subscription management - Can be complex to set up for businesses without technical expertise - Customer support can be challenging for smaller merchants - Account stability concerns with some merchants reporting account freezes

// Example: Creating a subscription with Stripe

const stripe = require("stripe")("sk_test_...");

const subscription = await stripe.subscriptions.create({

customer: "cus_123456789",

items: [{ price: "price_monthly_standard" }],

trial_period_days: 14,

payment_behavior: "default_incomplete",

expand: ["latest_invoice.payment_intent"],

});Stripe is ideal for businesses that:

- Have in-house development resources

- Need extensive customization

- Process high transaction volumes (to offset development costs)

- Want to maintain direct control over the customer relationship

- Have systems in place for handling tax compliance

LemonSqueezy: The Indie Hacker's All-in-One Solution

LemonSqueezy has emerged as a popular alternative to Stripe, particularly among indie hackers, bootstrapped startups, and small SaaS businesses. It positions itself as a simpler, more integrated solution that eliminates many of the complexities associated with payment processing and tax compliance.

LemonSqueezy's unique selling points

LemonSqueezy differentiates itself through several key features:

-

Merchant of Record services that handle all tax compliance and regulatory requirements, including:

- VAT/GST calculation and collection

- Sales tax management for US and international markets

- Tax reporting and remittance

- Legal compliance with payment regulations

-

User-friendly dashboard designed for non-technical users with:

- Intuitive interface requiring minimal setup

- Built-in subscription management

- Customer communication tools

- Simple product and pricing configuration

-

Integrated marketing tools including:

- Email marketing capabilities

- Affiliate program management

- Customizable checkout pages

- Customer portal for self-service management

LemonSqueezy provides a complete ecosystem that goes beyond payment processing, offering tools that would typically require multiple separate services with a platform like Stripe.

Analyzing LemonSqueezy's fee structure

LemonSqueezy's pricing model is straightforward but comes at a premium compared to basic payment processors:

- Transaction fees: 5% + $0.50 per transaction

- No monthly subscription fees or platform charges

- No additional fees for features like subscription management or dunning

- All features included in the base pricing

While these fees are significantly higher than Stripe's base rates, the total cost comparison must consider:

- The value of Merchant of Record services (which can save thousands in accounting and legal fees)

- The reduced development time and resources needed for implementation

- The elimination of additional tools that might be required with Stripe

- The time saved through simplified tax compliance and reporting

For many small to medium SaaS businesses, especially those selling internationally, the higher transaction fees may be offset by these operational savings. This is particularly true for businesses without dedicated finance and development teams who would otherwise need to manage complex tax compliance manually.

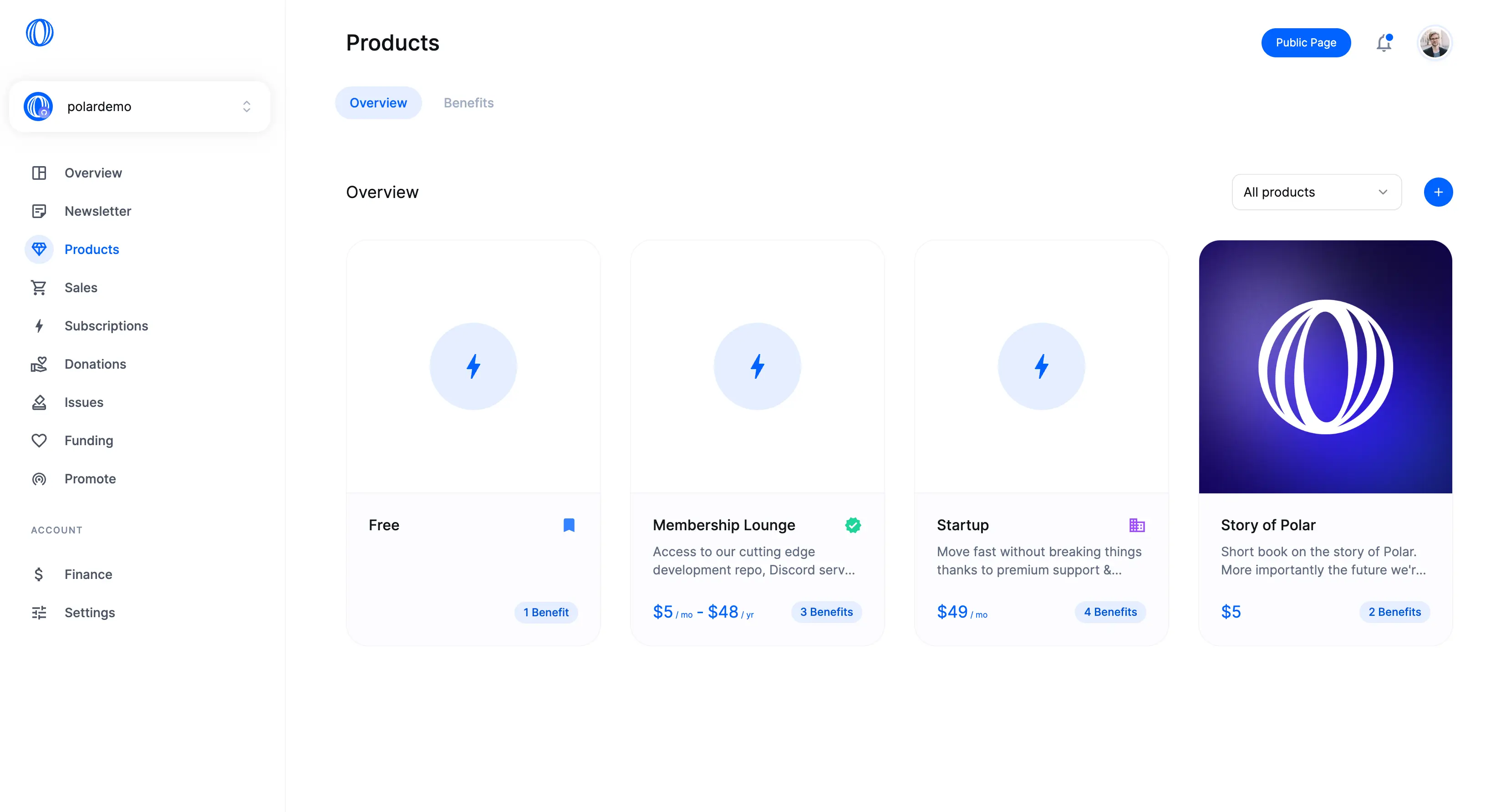

Polar: The Developer-First Payment Solution

Polar has positioned itself as a specialized payment solution designed specifically for SaaS companies, striking a balance between Stripe's flexibility and LemonSqueezy's simplicity. It offers robust developer tools while simplifying many of the complexities associated with subscription management.

How Polar differentiates from other providers

Polar stands out through its focus on SaaS-specific features and developer experience:

-

Purpose-built for SaaS businesses with features like:

- Usage-based billing for metered subscriptions

- Flexible subscription management

- Customer lifecycle optimization

- Revenue recognition tools

-

Developer-friendly approach including:

- Clean, modern API design

- Comprehensive documentation

- Ready-to-use components and SDKs

- Simplified implementation compared to Stripe

-

Streamlined tax compliance that:

- Automates tax calculation

- Simplifies reporting requirements

- Reduces administrative burden

- Provides necessary documentation

Polar effectively bridges the gap between full-service Merchants of Record like LemonSqueezy and bare-bones payment processors like Stripe, offering many compliance benefits without sacrificing developer flexibility.

Polar's pricing and integration capabilities

Polar's pricing structure positions it between traditional payment processors and full Merchant of Record services:

- Competitive transaction fees that reflect its specialized nature

- Simplified integration with popular SaaS tech stacks

- Support for complex pricing models including:

- Tiered usage pricing

- Hybrid subscription/usage models

- Volume discounts

- Feature-based pricing tiers

// Example: Creating a metered subscription with Polar

const polar = require("@polar/sdk");

const subscription = await polar.subscriptions.create({

customerId: "cust_123456789",

planId: "plan_standard_monthly",

usageMetrics: [

{

metricId: "api_calls",

reportingBehavior: "sum",

},

],

trialDays: 14,

});Polar is particularly well-suited for:

- SaaS businesses with technical resources but limited compliance expertise

- Companies implementing usage-based or hybrid pricing models

- Businesses seeking to minimize development time while maintaining flexibility

- Growing startups that want a scalable solution

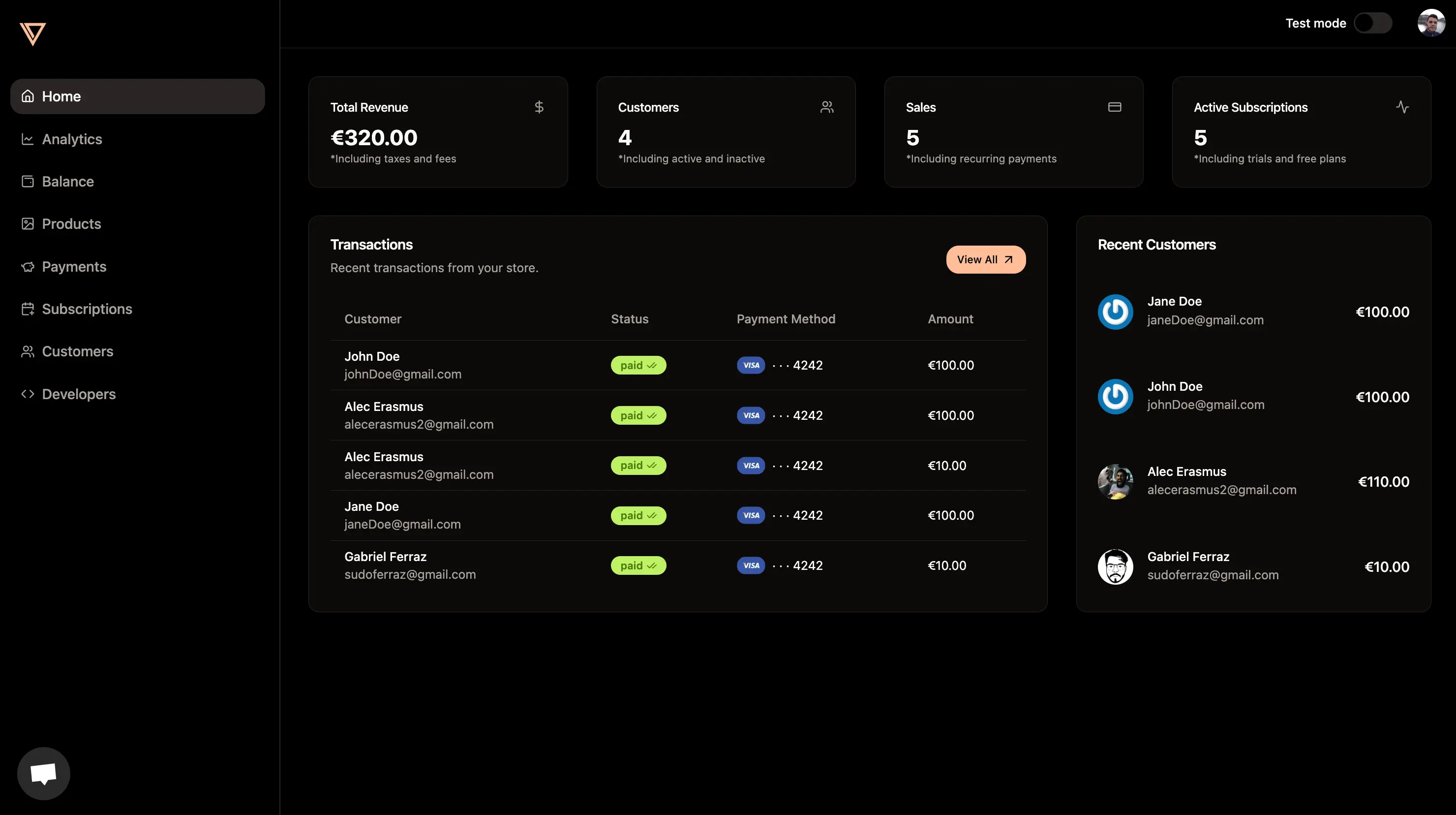

Creem: The Modern Design-Focused Payment Platform

Creem has emerged as a design-forward payment solution that prioritizes user experience and visual aesthetics. It offers a modern approach to payment processing that appeals to design-conscious SaaS businesses looking to create seamless, branded checkout experiences.

Creem's standout features for SaaS businesses

Creem differentiates itself through its focus on design and user experience:

-

Aesthetically pleasing checkout flows that:

- Maintain brand consistency throughout the payment process

- Offer customizable design elements

- Provide responsive layouts for all devices

- Optimize conversion through thoughtful UX design

-

Simplified subscription management with:

- Intuitive interfaces for both merchants and customers

- Clear visualization of subscription status and history

- Seamless plan switching and management

- Automated communication for subscription events

-

Merchant of Record services combined with:

- Modern design principles

- Streamlined tax compliance

- Simplified regulatory requirements

- Comprehensive documentation

Creem effectively combines the compliance benefits of a Merchant of Record with a premium design-focused approach that appeals to brands that prioritize user experience.

Is Creem the right choice for your business?

Creem is particularly well-suited for:

- Design-conscious brands that prioritize visual aesthetics and user experience

- SaaS businesses targeting creative professionals who expect polished interfaces

- Companies without dedicated design resources who want premium checkout experiences

- Businesses selling internationally who need tax compliance simplification

When evaluating Creem, consider:

- Transaction fees vs. design benefits - Is the premium for better design justified for your specific customer base?

- Integration capabilities - How well does Creem integrate with your existing systems?

- Technical requirements - Do you have the resources to implement and maintain the integration?

- Customer expectations - Does your target market value streamlined, aesthetically pleasing checkout experiences?

For many modern SaaS businesses, particularly those in creative industries or with design-savvy customers, Creem's focus on visual experience can translate to higher conversion rates and customer satisfaction, potentially offsetting the higher costs.

Which payment gateway has the lowest fees for SaaS businesses?

When comparing payment gateway costs, it's essential to look beyond the basic transaction fees to understand the true total cost of ownership for your specific business model.

Breaking down the true cost of each provider

Here's a direct comparison of the basic fee structures across all four providers:

| Provider | Transaction Fee | Monthly Fee | Setup Fee | Additional Costs |

|---|---|---|---|---|

| Stripe | 2.9% + $0.30 | $0 (basic) | $0 | Tax tools, subscription management |

| LemonSqueezy | 5% + $0.50 | $0 | $0 | None (all-inclusive) |

| Polar | 3.5% + $0.40* | $0-$99* | $0 | Some advanced features |

| Creem | 4.5% + $0.45* | $0 | $0 | Premium design features |

*Note: Fees are approximate and may vary based on volume and specific features

This basic comparison reveals that Stripe has the lowest base transaction fees, but this doesn't tell the complete story. When evaluating total cost, consider:

- Development resources required for implementation and maintenance

- Tax compliance costs including software, accountants, and potential liabilities

- Additional tools needed for complete subscription management

- Time costs for managing multiple systems vs. an integrated solution

When higher fees might actually save you money

In many cases, providers with higher transaction fees may actually result in lower total costs when all factors are considered:

Tax Compliance Automation

The cost of managing sales tax compliance across multiple jurisdictions can easily exceed thousands of dollars monthly when accounting for software, professional services, and potential audit risks. Merchant of Record services eliminate these costs.

Development Resources

Implementation and maintenance of a custom Stripe integration can require significant developer time, often costing $10,000+ initially and ongoing resources for maintenance. Simpler solutions reduce this burden substantially.

Revenue Recovery

Advanced dunning management can recover 20-30% of failed payments. This revenue recovery can offset higher transaction fees, particularly for businesses with higher involuntary churn rates.

Operational Efficiency

Integrated solutions reduce the time spent managing multiple systems, reconciling data across platforms, and troubleshooting integration issues—creating operational efficiencies that translate to cost savings.

For example, a SaaS business processing $50,000 monthly might pay $1,000 more in transaction fees with LemonSqueezy compared to Stripe, but could save $2,000+ monthly in tax compliance costs, development resources, and operational efficiencies.

The provider with the lowest total cost will depend on your specific business circumstances, including:

- Monthly transaction volume

- Average transaction size

- International customer base

- Internal technical resources

- Compliance requirements

- Growth trajectory

How to choose the right SaaS payment provider for your specific business

Selecting the optimal payment provider requires aligning the solution with your business's specific needs, resources, and growth stage. Here's a framework to guide your decision-making process:

Matching payment providers to business maturity stages

Different payment solutions align better with businesses at various stages of growth:

Early-stage startups typically benefit from:

- LemonSqueezy or Creem despite higher fees because:

- Minimal development resources are required

- Tax compliance is handled automatically

- All-in-one solutions reduce operational complexity

- Quick setup allows faster time-to-market

- Simplified reporting aids financial planning

Priority factors: Speed to market, simplicity, minimal development requirements, predictable costs

Growing businesses might leverage:

- Polar's balance of flexibility and convenience because:

- More complex pricing models can be implemented

- Developer resources are typically more available

- Partial compliance handling reduces burden

- Specialized SaaS features support growth

- Costs remain manageable as volume increases

Priority factors: Scalability, pricing flexibility, balance of control and convenience, growth-supporting features

Enterprise-level companies often maximize value with:

- Stripe's extensive capabilities because:

- Dedicated development teams can leverage the powerful API

- Lower transaction fees become significant at high volumes

- Custom integrations with other enterprise systems are possible

- Complete control over the payment experience is available

- Advanced reporting and analytics support complex needs

Priority factors: Maximum customization, lowest transaction fees, complete control, enterprise-grade security and reliability

Technical considerations and integration requirements

Beyond business stage, technical factors play a crucial role in determining the right provider:

-

Evaluate your team's technical capabilities:

- Do you have developers familiar with payment API integration?

- Can you maintain custom payment flows and handle updates?

- Is your team equipped to troubleshoot integration issues?

-

Consider existing tech stack compatibility:

- What programming languages and frameworks do you use?

- Do you need native mobile SDK support?

- How will the payment system integrate with your product?

-

Assess API flexibility requirements:

- Do you need to customize the checkout experience?

- Will you implement complex pricing or subscription logic?

- Do you require real-time webhooks for business events?

Remember that your payment infrastructure should grow with your business. The right solution today might not be the right solution a year from now. Plan for potential migration paths as your needs evolve.

The ideal payment provider should align with both your current capabilities and your future growth plans, providing the right balance of functionality, ease of implementation, and cost-effectiveness for your specific situation.

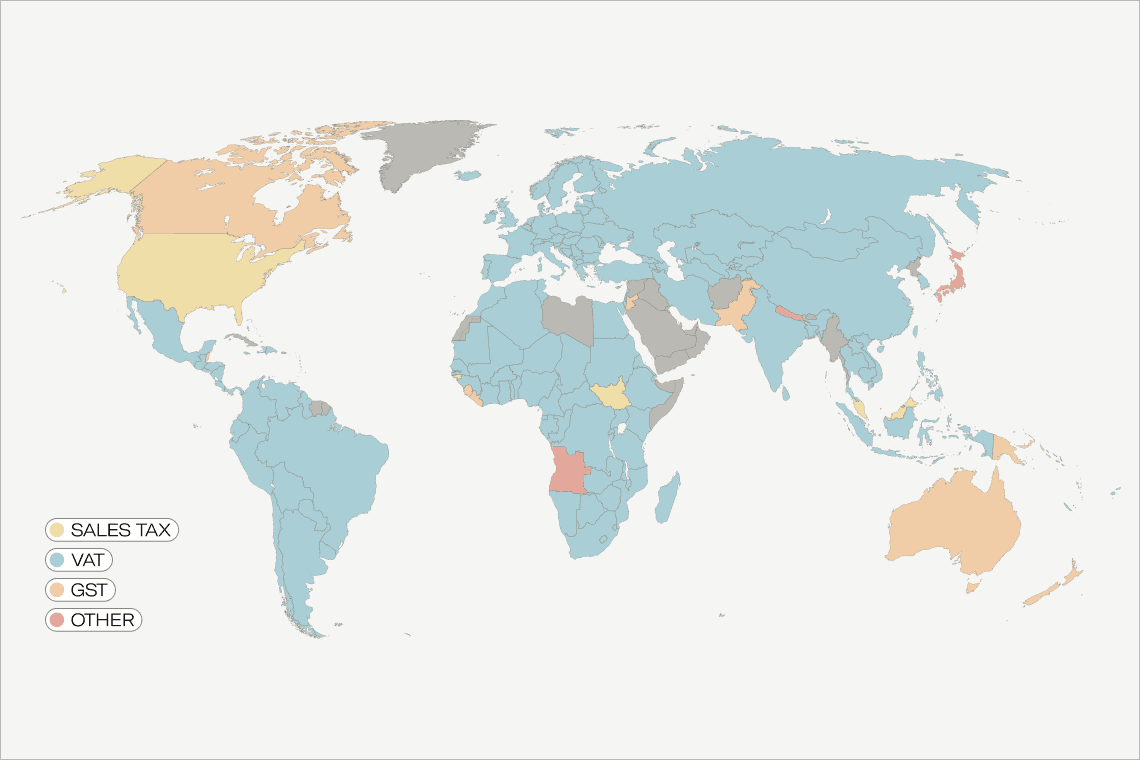

Tax Compliance and Global Payment Considerations

For SaaS businesses selling internationally, tax compliance presents a significant challenge that can impact your choice of payment provider. Different jurisdictions have varying requirements for digital service taxes, and failing to comply can result in penalties, audits, and legal complications.

How Merchants of Record simplify global tax compliance

Merchants of Record (MoR) like LemonSqueezy and Creem offer substantial benefits for international SaaS businesses:

-

Automated tax calculation and collection for:

- EU Value Added Tax (VAT)

- UK VAT

- Australian Goods and Services Tax (GST)

- Canadian Provincial Sales Taxes

- US State and Local Sales Taxes

- Other international consumption taxes

-

Tax registration management including:

- Maintaining registrations in required jurisdictions

- Updating for regulatory changes

- Handling tax authority communications

- Managing tax thresholds and requirements

-

Comprehensive compliance documentation providing:

- Tax-compliant invoices and receipts

- Required customer information collection

- Audit-ready transaction records

- Necessary reporting for tax authorities

Without a Merchant of Record, SaaS businesses must handle these requirements themselves, which typically involves:

- Registering for tax collection in multiple jurisdictions

- Implementing systems to calculate correct tax rates

- Collecting and storing appropriate customer information

- Filing regular tax returns in each jurisdiction

- Maintaining compliance with changing regulations

This administrative burden can be substantial, particularly for smaller teams without dedicated finance and legal resources.

Supporting international customers with multiple payment methods

Global payment support extends beyond tax compliance to include payment methods and currencies:

| Provider | Currency Support | International Payment Methods | Local Payment Options |

|---|---|---|---|

| Stripe | 135+ currencies | Excellent | Extensive local options |

| LemonSqueezy | 20+ currencies | Good | Limited local options |

| Polar | 30+ currencies | Very Good | Growing local options |

| Creem | 25+ currencies | Good | Moderate local options |

Key considerations for international payments include:

- Currency conversion capabilities - Can customers pay in their local currency?

- Multi-currency pricing options - Can you set different prices by region?

- Local payment method support - Beyond credit cards, do you support region-specific payment methods?

- Checkout localization - Are checkout experiences translated and culturally appropriate?

For SaaS businesses with a significant international customer base, these factors can substantially impact conversion rates and customer satisfaction. Stripe generally offers the most comprehensive international payment support, though the other providers continue to expand their global capabilities.

Subscription Management and Revenue Optimization

Effective subscription management is critical for SaaS business growth, directly impacting customer retention, revenue stability, and overall business health. Advanced subscription features can significantly improve key metrics like MRR, churn rates, and customer lifetime value.

Dunning management and failed payment recovery

Payment failures are a major source of involuntary churn for SaaS businesses. Effective dunning management—the process of recovering failed payments—can substantially impact your bottom line:

Smart retry logic determines optimal times to retry failed payments based on card type, failure reason, and customer behavior

Pre-dunning notifications alert customers before cards expire or when payment issues are anticipated

Customer communications through email, SMS, or in-app messages notify users of payment problems

Update card flows make it easy for customers to provide new payment information

Here's how the four providers compare on dunning capabilities:

| Provider | Automatic Retries | Smart Retry Logic | Customer Communications | Card Update Flows |

|---|---|---|---|---|

| Stripe | Yes (via Billing) | Advanced | Customizable | Flexible |

| LemonSqueezy | Yes | Good | Built-in | Simple |

| Polar | Yes | Very Good | Customizable | Developer-friendly |

| Creem | Yes | Good | Design-focused | User-friendly |

Effective dunning can recover 20-40% of failed payments, making it a critical feature for reducing revenue leakage.

Flexible pricing models and subscription changes

Modern SaaS businesses often employ complex pricing strategies that require sophisticated subscription management capabilities:

- Support for usage-based billing allows charging based on actual consumption of resources or features

- Tiered pricing structures enable offering different feature sets at various price points

- Hybrid models combine fixed subscription fees with usage-based components

- Self-service plan changes let customers upgrade, downgrade, or modify their subscriptions

- Prorated billing ensures fair charging when customers change plans mid-billing cycle

// Example: Implementing usage-based billing with Stripe

const stripe = require("stripe")("sk_test_...");

// First, report usage for a subscription item

await stripe.subscriptionItems.createUsageRecord("si_123456789", {

quantity: 100, // e.g., 100 API calls

timestamp: Math.floor(Date.now() / 1000),

action: "increment",

});

// Stripe will automatically calculate the bill based on the pricing modelThe flexibility to support various pricing models directly impacts your ability to optimize revenue and align pricing with value delivered. While all four providers support basic subscription management, they differ in their ability to handle complex pricing scenarios:

- Stripe offers the most flexibility but requires more development work

- LemonSqueezy provides good basic subscription management with limited complexity

- Polar excels at SaaS-specific pricing models including usage-based billing

- Creem offers solid subscription management with an emphasis on user experience

The right choice depends on your specific pricing strategy and how much flexibility you need to evolve that strategy over time.

Conclusion

Selecting the right SaaS payment provider is a critical decision that impacts everything from your day-to-day operations to your long-term growth potential. Each of the providers we've examined—Stripe, LemonSqueezy, Polar, and Creem—offers distinct advantages that make them suitable for different types of SaaS businesses.

To summarize the key considerations:

-

Stripe remains the most powerful and flexible option but requires more development work and doesn't handle tax compliance. It's ideal for businesses with technical resources who need maximum customization and have the lowest possible transaction fees.

-

LemonSqueezy offers simplicity and all-in-one functionality with Merchant of Record services that eliminate tax headaches. Despite higher fees, it can be the most cost-effective solution for small to medium businesses when accounting for time saved and compliance benefits.

-

Polar provides a developer-first approach specifically designed for SaaS companies, balancing flexibility with convenience. It's particularly well-suited for businesses implementing complex pricing models who need more control than LemonSqueezy offers without the development burden of Stripe.

-

Creem focuses on creating beautiful, conversion-optimized checkout experiences while handling compliance requirements. It's perfect for design-conscious brands that prioritize user experience and visual aesthetics in their payment flows.

The ideal payment provider for your business will depend on your specific needs, technical resources, growth stage, and priorities. As your business evolves, regularly reassess your payment infrastructure to ensure it continues to support your goals efficiently.

Remember that your payment provider isn't just a technical implementation—it's a strategic business decision that directly impacts your customer experience, operational efficiency, and bottom line. Choose wisely, and you'll build a strong foundation for sustainable SaaS growth.